SwipeawayHiddenfees

Cut your costs, not your processor.

We’ll reduce your processing fees without changing anything.

- In transactions

- $7B

- Savings achieved

- $10M

- Clients

- 320+

How it works

simple process, same processor

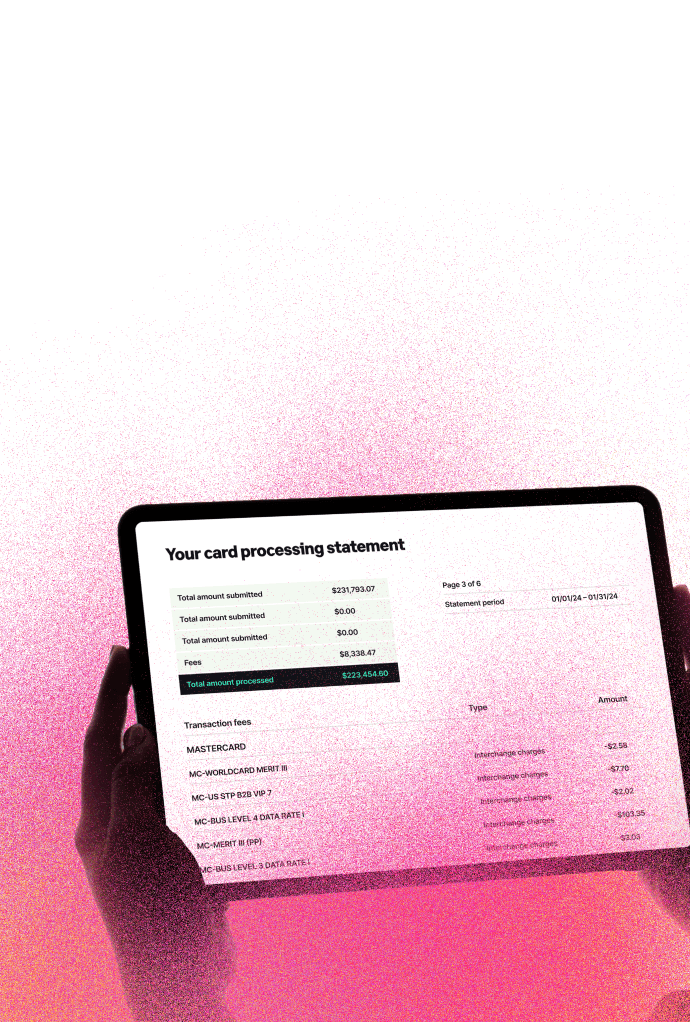

Upload a credit card processing statement, and we’ll make sure you’re never paying more than you should to accept payments. It’s that easy.

Consulting

Unbiased paymentconsulting

From unbiased vendor selection to complex integration solutions, we’ll find solutions that best fit your business today – with flexibility for the future.

Making a big differenceto your bottom line

Our AI illuminates hidden savings, uncovering unfair costs in unreadable statements. With expert insights and ongoing monitoring, we keep processors honest and businesses empowered.

Zero disruption

Zero disruptionBig savings, without changing anything. No need to ditch your processor, hardware or software.

Unbiased advice

Unbiased adviceOn your side, and committed to making sure you’re never paying more than you should be.

Frictionless process

Frictionless processNo applications, no underwriting, no risk or out-of-pocket costs — and less than 1 hour of your time to get started.

Profit protectors

Profit protectorsSee real savings today, with minimal effort, and protect your profits into the future.

The Industry is Broken

The world of credit card processing is unclear, untrustworthy and unregulated. But it doesn’t have to be.

Loved by businesses (not so much by processors)

Real savings, regardlessof your industry

- Retail & eCommerce

- Food & Beverage

- Hospitality & Travel

- Automotive & Transportation

- Professional & Home Services

- Entertainment & Recreation

- Utilities, Energy & Telecom

- Industrials & Manufacturing

- Education, Nonprofits & Charity

- Government & Public Services

- Construction & Industrial Supplies

- Personal Care & Beauty Services

- Business-to-Business Services

- Wellness, Sports & Fitness

- Media & Publishing